Amidst the coronavirus outbreak, telehealth has played a significant role in managing the U.S. population’s basic medical needs. It is now apparent that telehealth offers significant benefits to our healthcare structure—and it is likely we will see its use increasingly normalized going forward.

There are obvious opportunities here for healthcare software and IT organizations that can bring performance-driving innovations to providers. It is imperative that vendors understand the market before connecting product value to these trends.

Commercial Claims data holds many critical insights into telehealth use that cannot be retrieved any other way. Telehealth identifiers span unique code types and modifiers. Keep reading for insights on how to best leverage claims data for one-of-a-kind telehealth market insights.

How to mine telehealth data through medical claims

There is a unique complexity to achieving a full, 360-degree view of telehealth use during the COVID-19 pandemic. Here are three ways you can collect telehealth data through medical claims.

1. CPT codes

There are several CPT codes that reference telehealth specifically. For example:

- 98969: Online services by a healthcare professional (non-physician)

- G0425-G0527: Inpatient/ED online consultation; 30, 50, or 70 minutes

- G0406-G0408: Inpatient telehealth follow-up; 15, 25, or 35 minutes

- Q3014: Telehealth facility fee

CPT codes are the most standard approach to collecting telehealth claims data. While these codes have not seen a ton of use in previous years, there has been a massive surge in usage driven by COVID.

Starting with a collection of telehealth-specific CPT codes creates a strong foundation for any telehealth analytics project and can deliver some astounding insights. Relying on these codes alone will not provide a complete picture, however.

2. Place of Service Code 02

In general, Place of Service Codes are used to identify the location where a procedure took place. This can be a surgery center or a private practice, etc. Place of Service Code 02, specifically, refers to health services provided via a telecommunication system—also known as telehealth.

3. CPT modifier 95

Physicians have the option to fill in up to three modifier codes for additional specificity when reporting any CPT code. The modifier of 95 tags a claim as telehealth. This is how you will find the large majority of telehealth claims.

Prior to 2018, the modifiers GT and GQ were used for the same purpose as the current modifier of 95. Account for this when researching historical telehealth trends.

Pulling market insights from a complete telehealth data set

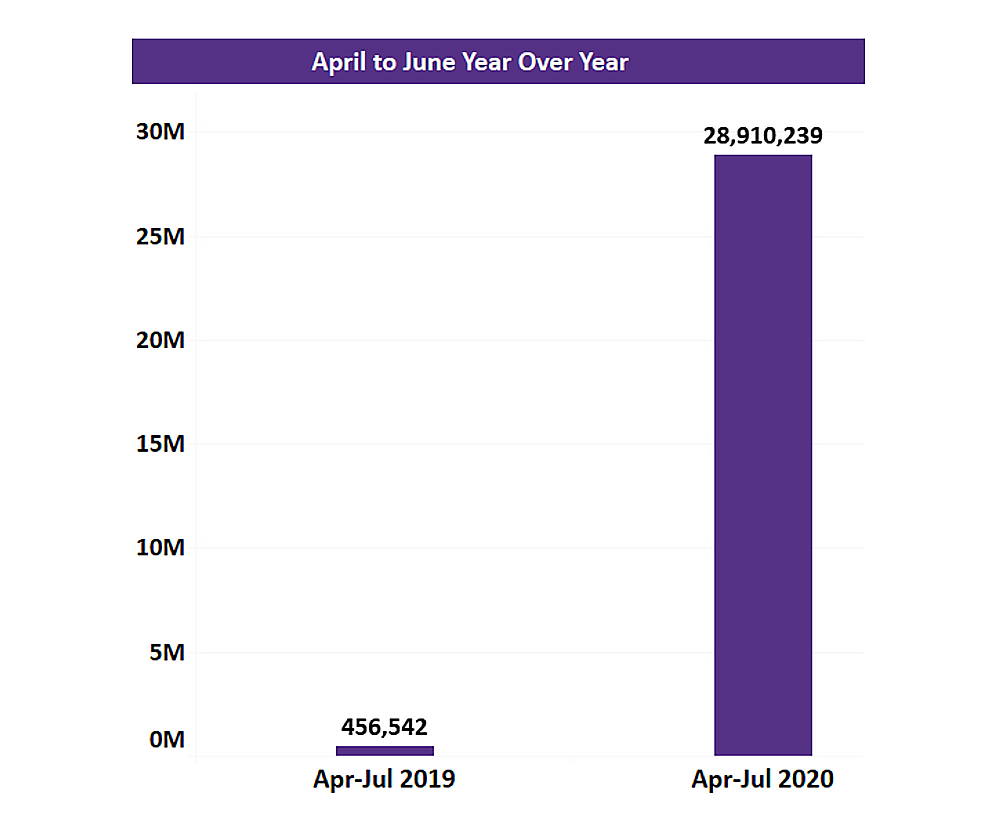

Once you have pulled data using all available telehealth code identifiers, you can then sort it for some truly surprising insights. In a Definitive Healthcare claims-based webinar, Examining the COVID-Driven Rise of Telehealth with Claims, analysts used this method to uncover a 6000+ percent increase in telehealth claims from the summer of 2019 to the summer of 2020.

Telehealth claims reported: Summer 2019 vs. Summer 2020

Fig. 1: Data from Definitive Healthcare’s Medical Claims database. Claims data is sourced from multiple medical claims clearinghouses in the United States. Data is updated monthly. Accessed August 2020.

We also see that the primary care specialty tapers off after its massive uptick and continues to drop in the timeframe captured. However, we can also see that some of the other specialties have remained consistent in their telehealth claims use since that April 2020 peak.

This is a fun, quantitative statistic, but it may not help organizations truly isolate their ideal segment of the telehealth market. Leveraging data to its fullest potential demands some creative thinking.

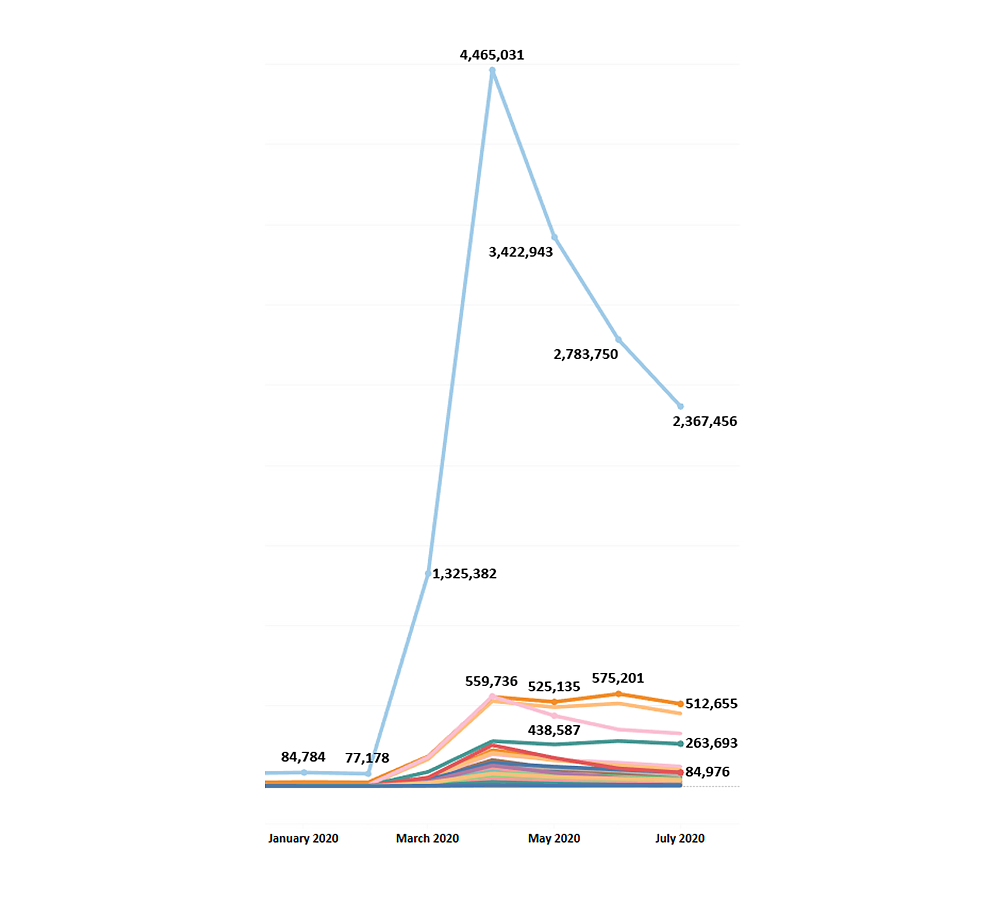

A good jumping-off point is to break down claims data by physician specialty.

The webinar highlights that primary care physicians (represented by the blue line in the chart below) reported the most telehealth claims in 2020, with a peak of 4.5 million in April. For comparison, the next highest specialty reported only 560,000 claims in this same month.

Telehealth claims through June 2020 by volume per specialty

Fig. 2: Data from Definitive Healthcare’s Medical Claims database. Claims data is sourced from multiple medical claims clearinghouses in the United States. Data is updated monthly. Accessed August 2020.

We also see that the primary care specialty tapers off after its massive uptick and continues to drop in the timeframe captured. However, we can also see that some of the other specialties have remained consistent in their telehealth claims use since that April 2020 peak.

While there may not be much to do with the primary care physician drop-off rate data—aside from avoiding any rash decision-making for the time being—observing which specialties appear to be maintaining telehealth usage is highly useful information. With it, we can now assume that these particular specialties are prime prospects for telehealth technology improvements.

Learn more

For more information on telehealth trends and a full look at these insights and more, watch our 15-minute webinar, Examining the COVID-Driven Rise of Telehealth with Claims.

In this webinar, Todd Bellemare and Casey Eastlack of the Definitive Healthcare Professional Services team discuss ongoing telehealth regulation changes, the most standout telehealth COVID-19 stats of 2020, as well as everything touched on within this blog in much greater detail.